Act to Earn Reputation 2023

Trust in business down, appetite for intervention up…

It’s hardly a surprise - trust in business is down as the cost-of-living crisis continues to grip the UK. As households across the country feel the pinch, the public are looking more closely at the conduct and decisions of businesses.

Our research shows the sectors facing the greatest public scrutiny have seen an increase in support for Government intervention. Public support for nationalisation has risen for the water and rail sectors, and there are increased calls for regulation and investigation of other sectors including construction, tech, finance and the supermarkets.

But it is notable that while trust in business may be down, trust in government remains lower. And trust in politicians has fallen since our last survey. Britain’s policymakers are now less likely to be trusted than any business, large or small.

As we have said before, there is space for businesses to step up and lead. Our research shows there are routes for businesses, and whole sectors, to rebuild reputation and trust, even this year when scrutiny is heightened.

Over the last three years, we have conducted significant opinion research which has consistently shown the public expect all businesses to reflect the values they hold dearest – respect, loyalty and reliability. Alongside these values, we share an insight into the themes companies can choose from - which align with their commercial goals and contribution they make – to build stories and campaigns to build reputation and trust. They include ideas such as ‘looking after employees’, ‘thinking about future generations’ and ‘helping tackle the climate crisis – all of which have grown in importance since 2022. This is perhaps reflective of the year we've experienced: While trust in business is down, there is growing appetite and interest to hear more about which sectors are seeing growth, and how companies are working for the good of all stakeholders and their plans to create long-term, sustainable prosperity and get out of the cost-of-living crisis.

We have more detail, and further insights into specific sectors which we would be happy to share. For further information, please contact hello@5654.co.uk.

Businesses must act to earn reputation

Big business continues to be more trusted than government

Over the last three years, our research has consistently shown that big business is more trusted than Government and politicians. While trust in business overall is falling, trust in Government and politicians is falling faster.

Q6 Now, we want to talk about trust. Thinking about what you know and your experience of the following people/organisations in the UK (their function in society, services they provide, their behaviour as an employer), we would like to know, how trustworthy you would say they are?

Scale | 4004 respondents. Fieldwork: 3 July 2023 – 8 July 2023

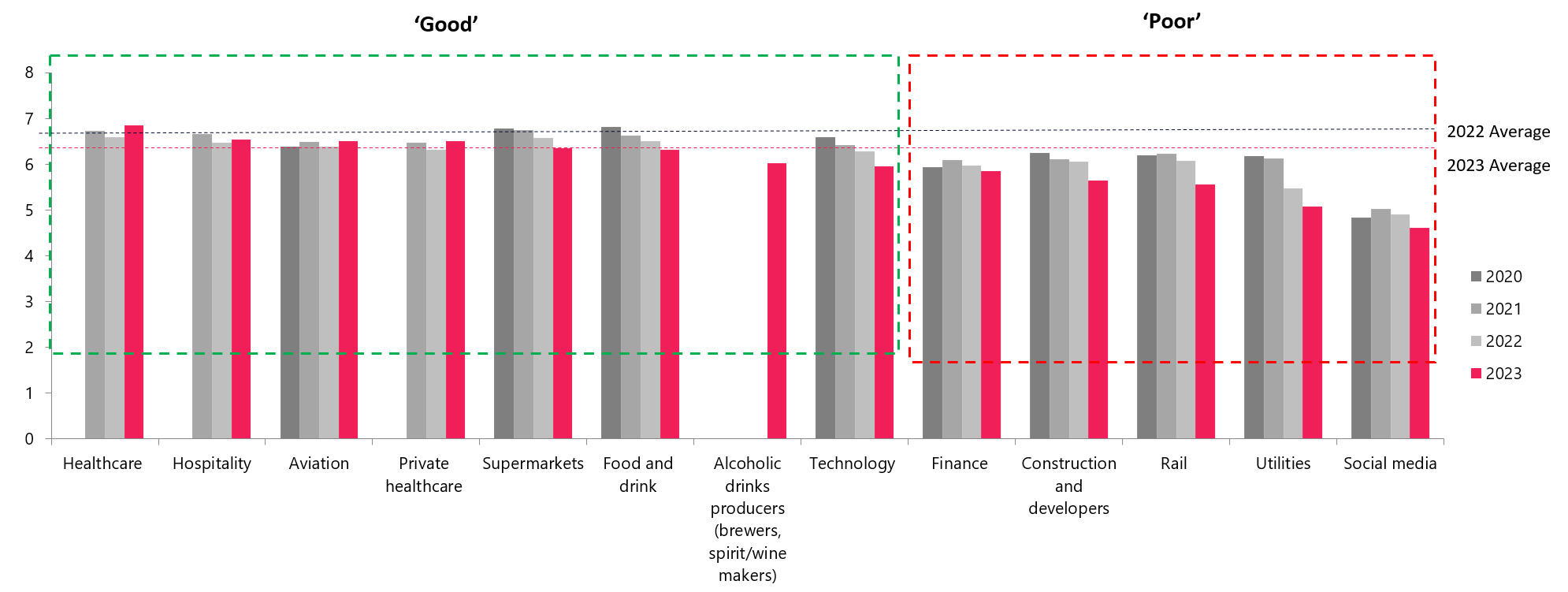

Trust has fallen overall, though some sectors are more trusted than others

Trust on average across sectors of business has fallen overall, dropping from 6.14 in May 2022 to 5.9 now. There is however variation across sectors, with certain sectors (healthcare, hospitality and aviation) becoming more trusted while other sectors have seen public trust fall away significantly in in the last year.

N.B. Sectors received an average score of 10 to calculate this ranking. ‘Good’ sectors rank above the average score and ‘Poor’ under the score. The average score trust score in this research was 5.9, down from 6.14 in May 2022.

Q7: And now thinking about various industries, how trustworthy do you believe these are specifically?

Scale | 4004 respondents. Fieldwork: 3 July 2023 – 8 July 2023

Labour voters are less likely to trust business

Conservative voters have greater trust in business across the board. The starkest contrast between voters is with trust in the utilities, with Labour voters more likely to distrust both energy and water companies than trust them.

Q7: And now thinking about various industries, how trustworthy do you believe these are specifically?

Scale | 4004 respondents. Fieldwork: 3 July 2023 – 8 July 2023

Since February, the public have become more supportive of Government intervention

Since February, the public have become more supportive of Government intervention across sectors. There are notable increases in support for intervention into water companies, supermarkets, rail, social media and construction. The public are also generally less likely to have no opinion about government intervention, with the percentage of people answering ‘Don’t know’ falling across nearly all sectors polled.

Q13: Thinking about the wide range of companies in the UK, we'd like you to tell us what, if any, new measures you feel the government should be taking towards them. Please select all that apply

Scale | 4004 respondents. Fieldwork: 3 July 2023 – 8 July 2023

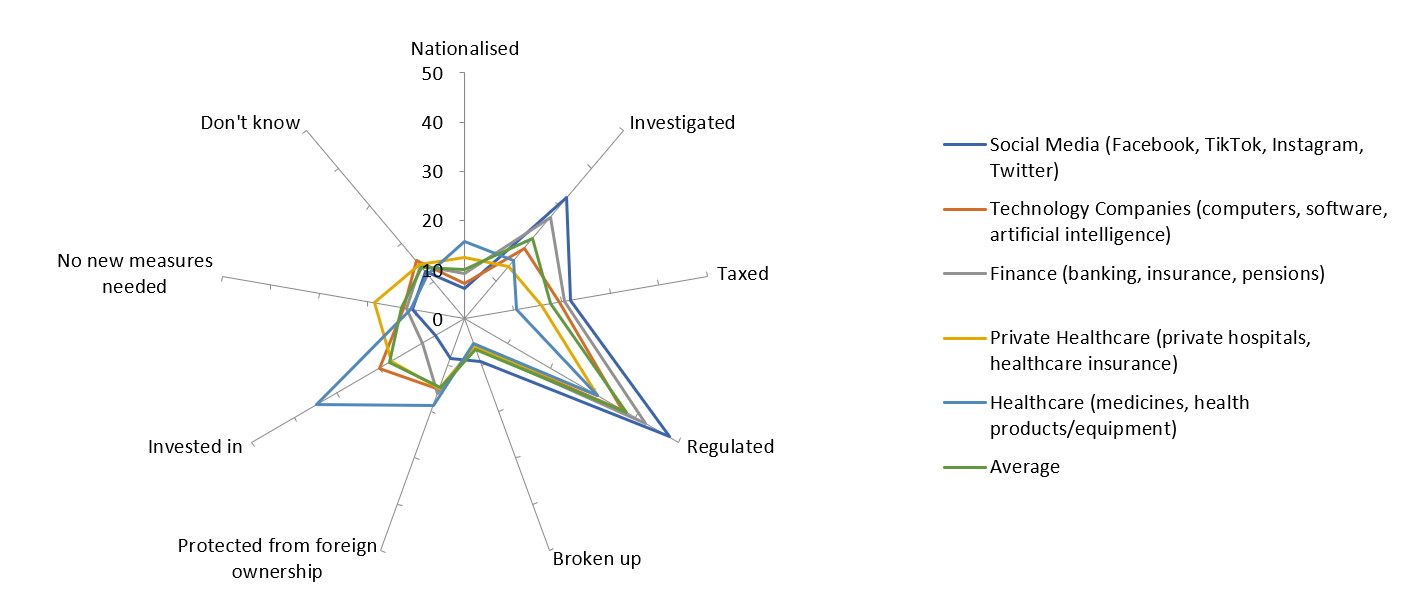

The public continue to lean towards regulation, though for some sectors more than others

In the context of falling trust, we are seeing increased public support for government regulation.

There is a strong call for new regulation (and investigation to a lesser scale) for social media, technology and finance companies.

Interestingly in investment, healthcare (including medicines, health products and equipment) saw 35% of respondents want more investment compared to February this year.

Q13 Thinking about the wide range of companies in the UK, we'd like you to tell us what, if any, new measures you feel the government should be taking towards them. Please select all that apply.

Scale | 4004 respondents. Fieldwork: 3 July 2023 – 8 July 2023

For infrastructure, the public are calling for more regulation across the board

Against a backdrop of industrial action and falling trust in rail, over 40% of respondents support nationalisation for rail companies and are calling for more government regulation overall.

Similarly, falling trust in the utility sector overall has led to greater public support for the nationalisation of water and energy companies, as well a stronger call for government investigation into both sectors.

Q13 Thinking about the wide range of companies in the UK, we'd like you to tell us what, if any, new measures you feel the government should be taking towards them. Please select all that apply.

Scale | 4004 respondents. Fieldwork: 3 July 2023 – 8 July 2023

Support for regulation for hospitality is minimal, though calls for regulation of supermarkets is growing

Public support for intervention into hospitality (bars, restaurants, hotels) is low, with only 21% supporting further government regulation to the sector.

In comparison, there is growing support for regulation for supermarkets and food and drink manufacturers, as well as greater calls for government investigation into these companies.

Q13 Thinking about the wide range of companies in the UK, we'd like you to tell us what, if any, new measures you feel the government should be taking towards them. Please select all that apply.

Scale | 4004 respondents. Fieldwork: 3 July 2023 – 8 July 2023

Methodology

Poll: We interviewed 4,004 British adults online between 3rd July – 8th July. The data is representative of the British adult population.

A note on our regression approach:

All the above charts have narrowed down the statements we used in our regression analyses to those which were 'statistically significant' in driving hope or trust.

We have taken the "Relative Importance" score from the regression model, as this gives us each statement's contribution to r-square (which is the number that tells us how well the data fits to our regression model i.e. strength of relationship), in percentage form.

This score is more resilient to relationships between the statements themselves than regression coefficients.

It is also worth noting that each regression was run more than once, with the second (and third and fourth) iteration removing the small pool of respondents who were providing 'bad data' (i.e. an algorithm was used to spot any non-logical responses, that would suggest low integrity in the respondents answers).

This gives us greater confidence in the "Relative Importance" scores for our statements, as it lifted the R-square number and ensured the relationship between the statements and ‘trust' were even stronger.